Why Medication Management Matters

As seniors age, they may require several medications to manage chronic conditions. Without proper management, there is a higher risk of missed doses, incorrect timing, or harmful drug interactions. Effective medication management supports health, prevents complications, and reduces hospital visits.

Common Challenges Families Face

- Remembering multiple prescriptions with different schedules

- Understanding complex instructions or medical terminology

- Ensuring medications are stored safely and securely

- Managing side effects or monitoring for changes in condition

- Coordinating between doctors, pharmacies, and care providers

Families often turn to professional care providers when the responsibility becomes overwhelming. For guidance on how we support care decisions, explore our Frequently Asked Questions.

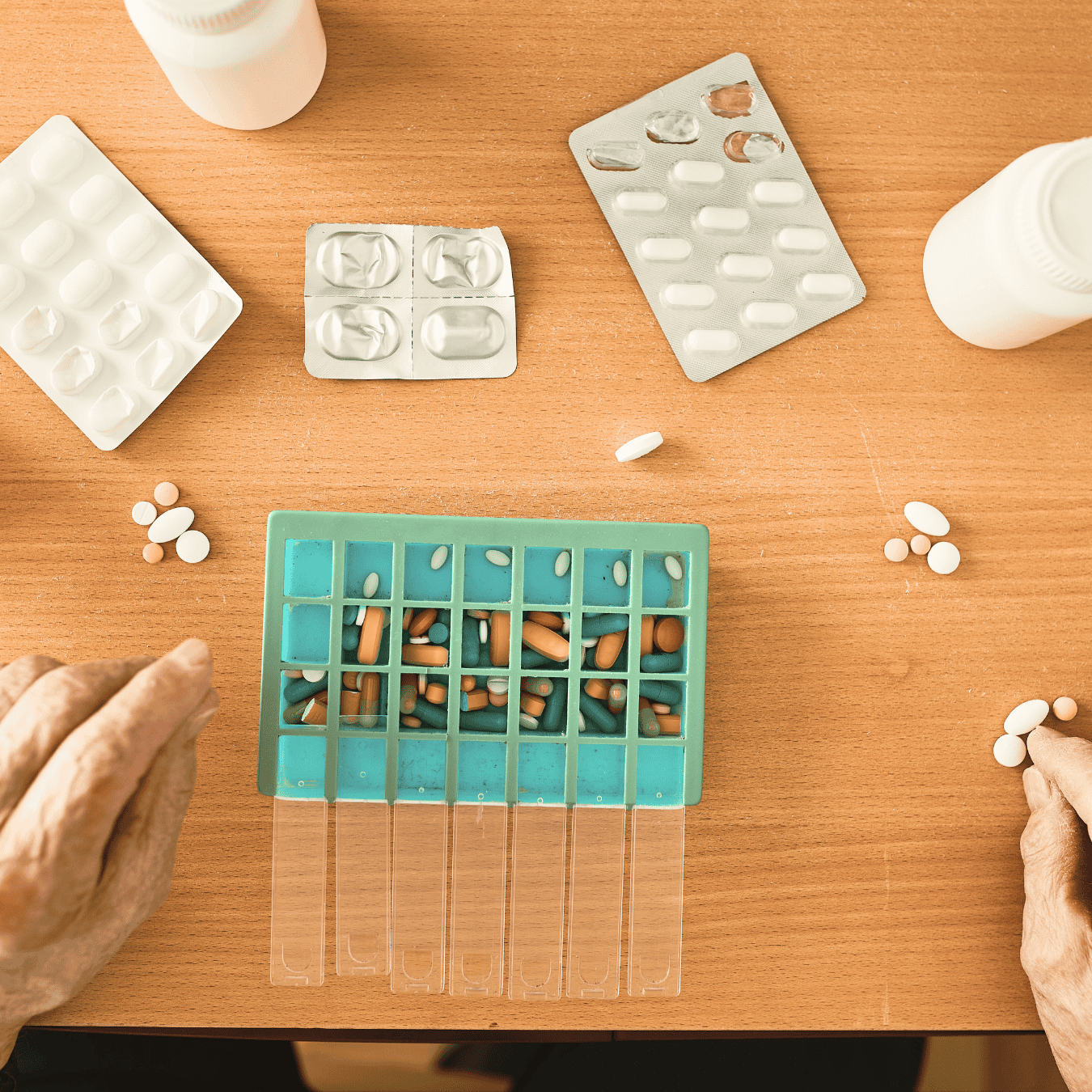

Practical Strategies for Safer Medication Use

- Use clearly labelled pill organisers with daily or weekly compartments

- Keep an up-to-date medication list to share with doctors and caregivers

- Set reminders through alarms or phone notifications

- Schedule regular reviews with a healthcare professional to avoid duplication or interactions

- Involve seniors in their routines to maintain dignity and independence

TOTALCARE’s Approach to Medication Management

At TOTALCARE Living, our trained staff oversee medication management with compassion and precision. From administering daily prescriptions to coordinating with doctors and pharmacies, we ensure every resident receives reliable support. For families exploring long-term stability, our Life Right model offers not only accommodation but peace of mind that care, including medication oversight, is always part of the journey.

If you or your loved one are concerned about managing multiple medications safely, TOTALCARE can help. Visit our FAQ page for quick answers or learn more about our secure Life Right model that combines financial stability with professional care.